Due to the open nature of the Internet, all web-based services such as YAB’s Online Banking are inherently subject to risks such as online theft of your User ID/UserName, Password, virus attacks, hacking, unauthorized access and fraudulent transactions.

What are risks about online and mobile banking?

What is the main problem in online banking?

Security and fraud instances Security and protection against fraud and hacking are some of the most significant challenges for banks promoting online banking.

What is legal risk in e banking?

This is the risk to earnings or capital arising from violations of, or nonconformance with, laws, regulations and ethical standards. Compliance risk may lead to diminished reputation, actual monetary losses and reduced business opportunities.

What are some risks of mobile banking?

banking session or capture sensitive customer information. However, in the rush to get mobile applications to market, secure code review and testing may not be sufficiently robust. Also, mobile banking can be compromised by the installation of rogue, corrupt, or malicious applications on a customer’s mobile device.

What is a serious problem faced by users of e-banking?

The study shows that network failure from internet connection is the major challenge facing customers using E-banking services.

Which is safe mobile banking or Internet banking?

Bankrate.com says that online banking is less secure than a bank’s mobile app. “Some banks that have multi-factor authentication on their mobile apps don’t provide the same capability on their websites. Well-designed mobile apps don’t store any data, and you’re less likely to hear about a virus on a smartphone.”

Can mobile banking app be hacked?

Tricking Users With Fake Banking Apps The simpler means of attack is by spoofing an existing banking app. A malware author creates a perfect replica of a bank’s app and uploads it to third-party websites. Once you’ve downloaded the app, you enter your username and password into it, which is then sent to the hacker.

What are the major risks in e payment?

RISK OF E PAYMENTS Stolen Payment credentials and passwords. Dishonest merchants for financial service providers. Disputes over quality of services and products.

Is electronic banking considered high risk?

The guidance defines high-risk transactions as those that allow the transfer of funds to third parties or provide access to nonpublic personal information. For example, bill pay, a common Internet banking product, allows funds to be transferred to third party payees. This is considered a high-risk transaction.

Are online only bank accounts safe?

Banks take the security of accounts very seriously and invest lots of time and money to make sure your online account is safe. Bank websites are encrypted. This means they are well protected from anyone seeing the information on the page or your personal details.

What is a disadvantage of digital payments?

Disadvantages of Digital Cash The problems which still exist are as follows: Not Traceable: The digital cash uses the internet, which makes traceability difficult. Hence, the system provides anonymity. This can be a good thing but also a bad thing.

Are digital payments safe?

Security is paramount; digital payments are not only authorized but they must be authenticated as well. From a regulatory perspective, strong customer authentication, using two or more factors, for online payments is in place across the EU and is being increasingly adopted around the globe.

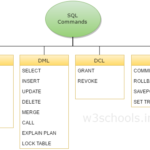

What is difference between Internet banking and online?

Internet Banking is a method of banking in which transactions are conducted electronically via the internet. E-banking includes various regular transactions such as internet banking, mobile banking, ATM’s, smart cards.

What is the advantages of online banking?

Online banking allows you to have some of your paycheck directly deposited into your savings account or funds can be scheduled to automatically transfer from your checking to your savings. Make loan payments. Avoid late fees by scheduling all of your loan payments before the due date. Mobile deposits.

What is the safest way to do online banking?

The safest way to bank online is to access your bank’s official online or mobile banking app using a secured Wi-Fi connection. Banking with unverified or untrusted apps or over unsecured Wi-Fi connections could leave you vulnerable to cyberattacks.

What’s the difference between Internet banking and online banking?

Online banking allows a user to conduct financial transactions via the Internet. Online banking is also known as Internet banking or web banking. Online banking offers customers almost every service traditionally available through a local branch including deposits, transfers, and online bill payments.

Which browser is safest for online banking?

The Edge browser in Windows 10 is a new sandboxed app, so it’s much better for banking than Internet Explorer. Otherwise, Chrome is the most secure alternative, because it runs in Google’s own strong sandbox. Some security companies also provide add-ons, such as Kaspersky Safe Money and Bitdefender Safepay.

Can someone hack your bank with your account number?

The Difference Between Routing Number and Account Numbers While someone cannot hack your account directly using only your bank’s routing number, a carelessly disposed physical check can compromise your bank account because personal checks contain both your routing and account number.

What someone can do with your bank account number?

When a scammer has your bank account and routing numbers, they could set up bill payments for services you’re not using or transfer money out of your bank account. It’s tough to protect these details because your account number and routing number are hiding in plain sight at the bottom of your checks.

Can someone hack your bank account with your name and email?

Your online bank accounts can also be a major target for hackers, especially if you use your email address as a login for those, too. And, needless to say, once a hacker has access to those, your money is in serious jeopardy. “This is one of the biggest risks you’ll face from an email hack,” Glassberg says.

Which of the following is not the benefit of online banking?

This is Expert Verified Answer Option b)Provides a competitive advantage to the bank is not the benefit of e- banking to the customers. Electronic banking, Use of computers and telecommunications to enable banking transactions to be done by telephone or computer rather than through human interaction.