The XBRL Filing Services is an extra efficient instrument of transfer, unification, and analysis of financial data of different corporations.

Customers usually put these questions «what is xbrl?» and «what is XBRL format? » To get the answers we recommend you to read the whole presented material.

The system known as the eXtensible Business Reporting Language has an XML standard to tag financial info for elevating the transparency of business info via uniform format over the world.

How to XBRL Filing Services

There are several steps any company should take to conduct financial reports filing via the XBRL system.

XBRL filing service supposes the creation of a defined type of initial documents and here is the roadmap of the process.

The first one is to map each financial indicator to the element in the published taxonomy that corresponds to it.

This determines the conversion of the accounting data into the proper XBRL form.

Then, it is necessary to do an instance doc containing a Balance sheet along with a Profit and loss account.

This doc is an XML file comprising business information – a scope of facts presented with the help of tagging from the XBRL taxonomy.

At this stage, you have to account that any extensions of the very core of Taxonomy are allowed.

There is also a list of separated documents to be created

– A Company’s Stand-Alone Balance sheet

– A Company’s Stand-Alone Profit and Loss Account

– A Company’s Consolidated Balance sheet

– A Company’s Consolidated Profit and Loss Account

At the end of step one is to review the whole document. It is crucial to avoid mistakes.

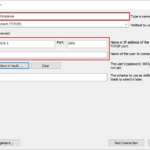

The next step is to download the XBRL validation tool.

There is a necessity to validate the instance document before XBRL filing.

You can download the tool of validation from the list of websites devoted to the XBRL service.

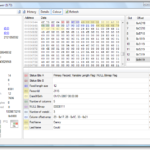

The third step is to scrutinize the documentation via special instruments and software.

And the last step is to download filed docs and submit them in compliance with the rules of the XBRL system.

XBRL Filing Service Corporate

The best way to do XBRL filing is to deal with a professional team that is keen on financial reporting via digital instruments such as XBRL.

That will allow you to avoid complicated routine and to match the demands of the EDGAR XBRL systems. Another factor to be taken into consideration is EDGAR filing deadlines – to do reporting in time is as much important as to do it correctly.

We provide corporate XBRL filing services for companies that are to file reporting data to the SEC.

The service we suggest:

– XBRL filing of 10-Q, 10-K, 20-F, 40-F, 8-K, 6-K, and all the other forms a client might need to be filed and submitted

– Registration Statements

– Conversion of all necessary forms in the decent standards XML, HTML, etc.

XBRL Filing Services

The factors that guarantee successful filing of the data we provide for our clients

– High watermark specialists. The team we have is trained in such algorithms as IFRS, GAAP, Risk & Return taxonomies and experienced enough in all the peculiars of the process.

– Fast reaction and turnaround. The team works in the USA. It means we react fast, communicate efficiently, implement changes at once.

– Quality Assurance. We do the validation, testing, double-checking, and final scrutinizing of all the material we work with. No errors as a standard!

– Consistency of files. If changing any doc, all the corresponded data is changed automatically.

Mutual Fund XBRL Filing Services

We do XBRL filing for Mutual Funds to the SEC by the Investment Management Rules 485 and 497.

It supposes XBRL filing of the following forms: 485BPOS, 497.

We provide Risk/Return Summary conversion into XBRL format.

And of course, we provide EDGAR/HTML conversion of prospectuses, registrations, and annual updates.